This is a paper presented by Ekaterina Howard, a recent graduate of the Global Digital Marketing and Localization Certification (GDMLC) program. This paper presents the work being produced by students of The Localization Institute’s Global Digital Marketing and Localization Certificate program. The contents of this Paper are presented to create discussion in the global marketing industry on this topic; the contents of this paper are not to be considered an adopted standard of any kind. This does not represent the official position of Brand2Global Conference, The Localization Institute, or the author’s organization.

E-commerce apparel sales in Russia were in second place for popularity by the number of unique visitors in 2015 based on eMarketer.com data (Russian Search Marketing, 2015), and will continue to hold this place in 2018 according to predictions from Statista (Statista, 2018, based on turnover).

At the same time, according to 2017 AKIT (Russian Association of Online Retail Companies) data (RBTH, 2017), foreign companies are way ahead of the Russian ones in the e-commerce market (37% and 6% respectively), primarily because of price. If the price regulations were to change, it is likely that competing on price would become less feasible. If that were to become the case, it is likely that adapting online presence to the preferences of Russian consumers will play a greater role.

As Angela Benoit pointed out in Breaking the Mold: Throwing Out Translation for an Intimate Look at Source Material, a session she gave at the ATA’s 57th Annual Conference (ATA Conference, 2016), and in her follow-up session the next year (ATA Conference, 2017), there are often significant differences in how same-industry companies in different countries present information about their products or services.

While the goal of the sessions was to “combat ‘translationese,’” looking at “native” websites also can be used to identify possible ways to adapt website copy (or the website structure) to increase sales. However, it would not be wise to act without taking a look at hard data first.

The Russian e-commerce market: differences, data, and hypotheses

- According to Romir, a third of Russians claims to speak English (20% can read and translate using a dictionary, 7% are familiar with colloquial language, and 3% identify as fluent speakers, according to RBTH, 2015).

- Based on the data for 2015 from eMarketer, 62% of Russians buying from e-commerce websites were repeat purchasers, 48% picked a site because they knew the web address for it, and 41% were picking sites recommended by friends and family (Russian Search Marketing, 2016).

- According to the Nielsen Global Connected Commerce Survey, 70% of Russians prefer to pay on delivery, 16% do not have a debit or credit card to buy online, and 62% do not trust giving credit card information online (Nielsen, 2016).

- Offers and discounts are leading contributors to making a purchasing decision, followed by free delivery, based on Yandex and GfK data (Balalaika Business Solutions, 2017; it is to be noted that in the same article it is stated that credit card payments finally overtook cash payments in 2016, also according to a study by Yandex and GfK (Balalaika Business Solutions, 2017).

Comparison: a selection of foreign and Russian women’s apparel websites

Website selection criteria

- translated their copy into Russian (excluding, for example, Macy’s, which delivers to Russia and lists prices in RUR, but does not have a localized website

- brand websites, instead of reseller websites, such as LaModa, Ozon, or Wildberries, all very popular in Russia (Russian Search Marketing, 2015), with websites found via “Russian apparel brands” search in Russian via Yandex

- a variety of price segments, excluding the luxury segment, where prestige and brand recognition play a greater role

Messaging hierarchy: definition and constraints

In this article I’ll use the messaging hierarchy as defined in the page breakdown graphics by Copy Hackers (Copy Hackers, 2016), where a page is broken down into two sections: message matching in the top 10% (also referred to as the hero section), and convincing in the remaining 90%.

Ten percent needs to match the messaging used in the search results and/or ads displayed on SERPs, as well as correspond to a customer’s stage of awareness. For more information on Eugene Schwartz’s classification of customer awareness levels, refer to the article by John Cole (CopyEngineer, 2012).

Given the likelihood that a homepage will attract visitors from all stages of awareness (i.e., “problem aware” – looking for women’s apparel; “solution aware” – looking for foreign brands or “Made in Russia” brands; or “product aware” – looking for a specific brand), it is not possible to tailor the message for one specific stage of awareness.

However, the goal of the homepage is clear – to encourage visitors to start browsing products.

But what about the remaining 90%? Joanna Wiebe lists the following questions that might need to be answered on a page to make it more convincing (Copy Hackers, 2016):

- What do you do?

- Why should I care?

- Do others like me care?

- Can you really do what you say?

- Why should I believe you?

- If I believe you, now what?

As you will see below, foreign brands frequently choose to focus on a visual display of their products and neglect to answer any of those questions.

Could they be losing out on additional customers by leaving them unanswered?

According to the data from eMarketer referenced above (Russian Search Marketing, 2015), Russian consumers prefer to make repeat purchases and will follow recommendations from friends and family or go to familiar websites (websites they know addresses for).

This means that new brands that come up as the results of an online search might need to overcome an initial reluctance to engage with an unfamiliar company. This needs to happen quickly: according to research by the Nielsen Norman Group (Nielsen Norman Group, 2011), brands have 10–20 seconds to communicate their value proposition to persuade website visitors to continue browsing.

In this case, homepages might need to work harder to persuade website visitors to continue browsing and – eventually – make a purchase. Given different delivery preferences and greater reluctance to make online purchases, it is possible that additional messaging on the homepage might make pages more effective. Based on the data about the preferences of Russian online buyers, I also took into account the availability of the following information on the homepages (all accessed on 05/05/2018):

- Country-specific information (foreign brands only, corresponds to a higher level of localization)

- Information on payment options (if not available, how many clicks will it take to get to that information), availability of local payment options

- Offers and incentives (discounts, sale notifications, promotions, etc.)

Localized homepages messaging hierarchy

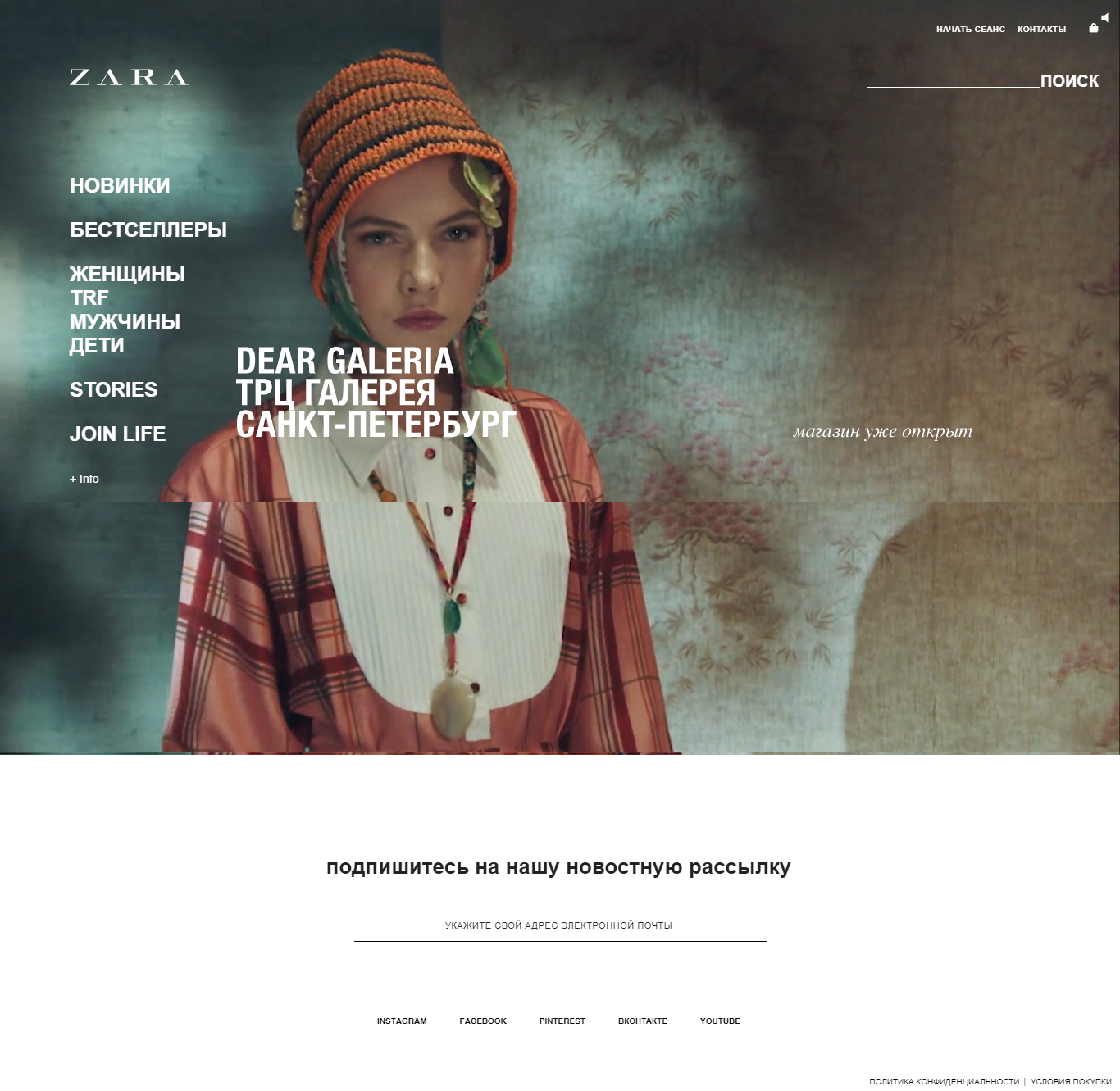

Zara Russia (Zara Russia, 2018)

Zara has a consistent minimalistic design with short product descriptions and a very short and visual homepage design. There are no “convincing” messages on the homepage.

Instead, there is a slider with collections and a notification about a new shop in Saint Petersburg.

All of the information about payment and delivery terms is located in a submenu and is accessible in two clicks.

There are no promotions and no incentives to purchase; instead, under the collections slider, website visitors are invited to sign up for a newsletter, almost as an afterthought (no compelling reason to subscribe is given).

H&M RU (H&M RU, 2018)

H&M’s homepage take the opposite to Zara’s. It serves as a hub to a wide variety of collections, from festive frocks to activewear and baby clothes.

The hero section also contains a slider, but there’s also a banner promoting a free shipping campaign.

Similarly to Zara, there are no positioning statements, value propositions, or customer testimonials. There is also no information about payment and delivery terms on the homepage. It would also take two clicks to get to that information. There are also no “convincing” messages; H&M relies on the visuals to encourage browsing.

On the other hand, there are multiple promotions, and a sale deadline is given in Moscow time (which could have been personalized further for different Russian time zones).

In addition to that, H&M provides several incentives to get visitors to subscribe to their newsletter: not only 25% off a purchase plus free shipping, but also an opportunity to be the first to find out about new products (a value proposition).

SheIn(Sheinside) (SheIn RU, 2018)

As opposed to H&M and Zara, this website relies heavily on sales and promos in the header section.

In addition to the “May holidays” (which is an excellent example of locally relevant campaign), there are three separate campaigns in the notification banners above.

The layout of the homepage is also very visual, but text is added to the images, highlighting trending collections, the most popular products, and specific lines of clothing, such as vintage.

There is a sidebar offering access to significant future discounts, exclusive deals, and a one-off discount for newsletter subscribers.

The primary goal is based on messaging hierarchy: take advantage of discounts or browse by category.

However, it slightly easier to find information about payment and delivery: this is located in the footer.

The homepage also has the “Gallery of looks” with user-generated content, which adds social proof and answers the question “Do others like me care?” for the website visitors.

NEXT Russia (NEXT Russia, 2018)

NEXT Russia also puts promotions and sales information front and center on their homepage, offering not only free overnight delivery, but also a COD payment option.

This homepage still has a very visual design, offering visitors a variety of options to continue browsing.

However, in addition to the social proof from the company’s Instagram channel, NEXT Russia also has authority proof – a collection of items selected by a Russian influencer for the brand.

It also offers an opportunity to connect on the Russian social media channel VKontakte, and references local and established partners, thus enhancing its credibility.

In addition to the new COD delivery terms, the homepage explicitly addresses the perceived challenges of online payments, promising “convenient payment options” (including Russia-specific ones) and “quick and cheap returns.”

Like SheIn, NEXT Russia also provides links to the terms of payment and delivery in the footer.

Russian homepages messaging hierarchy

RISE Collection (RISE Collection, 2018)

Unlike the foreign websites, the header on this website is significantly larger and contains information that might not be considered necessary, such as the address and office phone number of the company (in addition to the toll-free number for Russia). In the header menu, “Payment and Delivery” is the second link, followed by “About the Shop.” Links to collections and sales are relocated to the fourth level of the header copy.

After devoting a large portion of the hero section to static information, RISE Collection does use sliders in their page-wide banner, but references information about terms of delivery, terms of payment, return policies, and testimonials directly underneath the main banner.

After secondary banners with collections and repeated information about toll-free phone numbers, the homepage displays its social media links and then – unlike all of the foreign websites – it provides information about the e-store that contains its value proposition and gives reasons to buy.

A sign-up form is relegated to the footer, and no additional incentives are offered.

Interestingly, in addition to a link to the testimonial page, the footer also contains a testimonial quote from a client (and a second link to the testimonial page, highlighted in blue). The lowest footer level displays a logo for Russian Post, which handles deliveries.

In addition to the two mentions of a toll-free number, a sidebar offers a guaranteed timely response to a question from a customer. Online chats are not active on any of the localized websites.

Sogrevay (Sogrevay, 2018)

This homepage also devotes significantly more space in the hero section of the header menu, including not only social media links, but also toll-free numbers in addition to the standard search, login, and purchases links.

Just like many of the other websites, it uses a slider in the hero section, offering a seasonal discount and a new collection.

Like RISE Collection’s website, a variety of “convincing” messages are included below the hero section.

Directly beneath the hero banner they announce free delivery for all purchases over a certain amount, with a Russian Post package used in the banner.

Below the slider with different products, the homepage copy lists the advantages of buying from the online store.

Most notably, they include the following: “official website” (see a link below on the prevalence of counterfeit products in Russia), “honest testimonials,” “nationwide delivery,” the option to try on the purchased apparel before accepting it, and a second mention of the new terms for free delivery.

Just like RISE Collection, Sogrevay finds space on the homepage for testimonials, in this case tied to purchased products.

The footer contains icons for various payment options (including Russia-specific) and links to the payment and delivery terms.

BStatement (BStatement, 2018)

BStatement is the first website to have a specific and prominently-placed value statement on their homepage.

Like the other Russian websites, it also has a phone number included in the header section, but apart from having a link to the showroom, it does not try to enhance its credibility by posting its address in a prominent location.

There is a notification bar offering free delivery for one purchase over a specific amount, but other than that it is not overly reliant on incentives.

As with the other Russian websites, the homepage is a mix of visuals (a no-brainer for an apparel shop) and text, including reasons to buy.

As with NEXT Russia and SheIn, there is an Instagram feed (although this time it does not serve as social proof – all of the messages appear to be sales messages from the company; still, they do reference Russia-specific and time-specific reasons to buy – in this case, May holidays).

A newsletter sign-up in the footer is also not incentivized, but there are credit card payment options represented as logos in the footer.

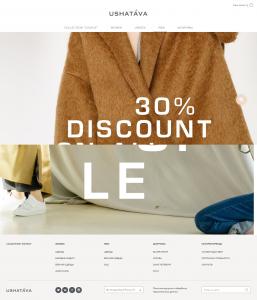

Ushatava (Ushatava, 2018)

The Ushatava homepage is the closest in design to the localized websites. It has no “convincing” information at all, and a two-image slider (new collection and a sale) serves as the primary message.

The header menu is also primarily devoted to collections but has a link to the information about the showrooms. However, the information about delivery terms is not hidden in a submenu but is instead accessible via the footer menu. The footer also contains social links and a search field.

12 Storeez (12 Storeez, 2018)

The 12 Storeez homepage manages to combine an approach centered around visuals while providing Russia-focused information by using overlays for menus and links. Overlay links are displayed over different image combinations and contain a direct link to testimonials (this website has a very wide variety of testimonials that are a gold mine for VOC and pain point research on delivery and payment in Russia).

Like most of the other Russian websites, 12 Storeez offers information on shop locations and makes contact information more prominent. Although there are two newsletter sign-ups — both a pop-up and an on-page form on the third slider — no sign-up incentives are offered in this case.

Localized and local homepages: a summary of differences in messaging hierarchy

In general, lower-price-segment websites have a more crowded look, relying on promotions to encourage visitors to browse, while websites that present their products as more high-end tend to choose layouts that are very visual and show incentives less prominently.

It is interesting that in many cases positioning statements and value propositions on Russian websites were relocated to “About” or “Brand history” sections, while foreign brands did not always have a clear positioning statement on their websites, perhaps relying on marketing and/or social media campaigns to raise awareness and position their brands (except for Zara, which apparently has a minimal advertising budget (Spark, 2017).

Not all of the Russian websites provide additional information on the homepage; companies with luxury aspirations tend to go for the “foreign” look and even sometimes use English in their copy (for example, only one link in the Ushatava menu is in Russian). Ultimately, however, the majority of Russian websites provides more context information about their companies on the homepage. Only Russian brands were using homepage real estate for positioning statements. Russian companies were also more likely to provide toll-free phone numbers and put their company address in header or footer of the website.

This corresponds to the advice from the article 7 Things Russians Expect on your Website (Russian Search Marketing, 2017, 7 Things Russians Expect on your Website), which also points out how widespread counterfeit clothing is and the need to distinguish yourself from “non-official” websites (Highsnobiety, 2018).

This also corresponds with what one might expect based on Hofstede’s Cultural Dimension model, specifically the high uncertainty avoidance. According to the information about Russia published by Hofstede Insights, “Russians feel very much threatened by ambiguous situations …[and] prefer to have context and background information” (Hofstede Insights, 2018).

However, despite the fact that the power distance dimension metric is very high for Russia – “The huge discrepancy between the less and the more powerful people leads to a great importance of status symbols” (Hofstede Insights, 2018) – only one website, and a foreign one at that, was using an influencer’s content on their homepage. However, the 12 Storeez brand is built around the designers/owners, so in this case they serve as influencers for their own brand. Although technically not referring to a person, Sogrevay e-store does use an appeal to authority figures to promote a line of matching sweaters for the whole family – “all the rage in Moscow” …or so they say on their website (Sogrevay Family Look, 2018).

On the other hand, the low individualism measure can explain why so many Russian websites link to customer reviews or embed them directly on the homepage: not only do those reviews help companies show that they are trustworthy, but they also help buyers to feel encouraged to become part of a group (while this might not hold true for other kinds of products, grooming and appearance are considered very important in Russia, and so are likely to generate emotional reviews and reactions). It is noteworthy that in many cases “About” pages are also written to facilitate self-selection.

Takeaway: possible homepage variations to test

While it would not be advisable to completely change the look of a homepage without taking into consideration a specific target audience and brand image, it might make sense to test the following tweaks to a homepage of an online store to see if they might result in a lower drop-off rate:

- a more prominent placement for terms of delivery and payment options

- adding secure payment information or logos closer to the start of the funnel

- adding information about your company to generate trust (unless you have an extensive media coverage or an established brand presence)

- offer additional options for delivery based on target audience preferences (and enabling the “try before accepting the package” option)

- include customer reviews from peers (from Russians, not translated reviews from buyers overseas)

Author Bio:

Ekaterina Howard is a translator (English to Russian and German to Russian) and a copywriter. She is a graduate of Belinda Weaver’s Copywriting Masterclass course and NYU’s Transcreation course (Angela Benoit), currently working her way through Copy School by Copy Hackers to be able to better implement the principles of conversion copywriting in localization of online copy for her clients. She is an active member of Carolina Association of Translators and Interpreters and American Translators Association, as well as the current Administrator of ATA’s Slavic Languages Division (SLD) and a co-host of SLD’s podcast.

Ekaterina Howard is a translator (English to Russian and German to Russian) and a copywriter. She is a graduate of Belinda Weaver’s Copywriting Masterclass course and NYU’s Transcreation course (Angela Benoit), currently working her way through Copy School by Copy Hackers to be able to better implement the principles of conversion copywriting in localization of online copy for her clients. She is an active member of Carolina Association of Translators and Interpreters and American Translators Association, as well as the current Administrator of ATA’s Slavic Languages Division (SLD) and a co-host of SLD’s podcast.

Connect with Ekaterina:

Website: https://yourcopyinrussian.com

References:

Russian Search Marketing (October 14, 2015), Russian Online Shopping: Top 10 E-Retailers & Top 10 Shopping Categories [Web blog post], retrieved 05/23 from https://russiansearchmarketing.com/russian-online-shopping-top-10-eretailers/

Statista, Forecasted retail e-commerce sales in Russia from 2015 to 2018 (in billion U.S. dollars) [statistic Web page], retrieved 05/23 from https://www.statista.com/statistics/289743/russia-retail-e-commerce-sales/

Anna Tretyak, Russia Beyond the Headlines (March 21, 2017), Russia’s retail e-commerce market soars 20% to $15.7 billion [online article], retrieved 05/23 from https://www.rbth.com/business/2017/03/20/russias-retail-e-commerce-market-soars-20-to-157-billion_723426

ATA 57th Annual Conference, Sessions by Language (2016), retrieved 05/23 from http://www.atanet.org/conf/2016/bylanguage/#F-6

ATA 58th Annual Conference, Sessions by Language (2017), retrieved 05/23 from http://www.atanet.org/conf/2017/bylanguage/#F-5

Interfax, Russia Beyond the Headlines (December 03, 2015), Percentage of Russians who speak English doubles to 30% [online article], retrieved 05/23 from https://www.rbth.com/news/2015/12/03/percentage-of-rusians-who-speak-english-doubles-to-30_547189

Russian Search Marketing (June 21, 2016), 7 Reasons for Cross border Sales in Russia [Web blog post], retrieved 05/23 from https://russiansearchmarketing.com/cross-border-sales-in-russia/

Nielsen News (January 26, 2016), What’s in Your Customer’s Digital Wallet? Preferences Vary Greatly Around the World [online article], retrieved 05/23 from http://www.nielsen.com/eu/en/insights/news/2016/whats-in-your-customers-digital-wallet-preferences-vary-around-the-globe.html

Fausto Bafico, Balalaika Business Solutions (March 21, 2017), E-commerce in Russia: What You Need to Know to Sell Online in Russia in 2017 [Web blog post], retrieved 05/23 from http://www.balalaika-bs.com/en/blog/e-commerce-in-russia-what-you-need-to-know-to-sell-online-in-russia-in-2017-/

Joanna Wiebe, Copy Hackers (June, 2016), Page Breakdown for Messaging Hierarchy [blog post and graphics], retrieved 05/25 from https://copyhackers.com/2016/06/copywriting-principles-sweatblock/page-breakdown-for-messaging-hierarchy/

John Cole, CopyEngineer (September 20, 2012), The Most Important Question to Ask Yourself When Creating a New Marketing Campaign [blog post], retrieved 05/25 from http://www.copyengineer.com/post_five_levels_customer_awareness/

Jakob Nielsen, Nielsen Norman Group (September 12, 2011), How Long Do Users Stay on Web Pages? [online article], retrieved 05/25 from https://www.nngroup.com/articles/how-long-do-users-stay-on-web-pages/

Zara Russia website, 2018, https://www.zara.com/ru/

H&M RU website, 2018, http://www2.hm.com/ru_ru/index.html#modal-1

SheIn RU website, 2018, https://ru.shein.com/

Next Russia website, 2018, http://www.next.com.ru/ru

RISE Collection website, 2018, https://www.riseshop.ru/

Sogrevay website, 2018, https://www.sogrevay.ru

BStatement website, 2018, https://bstatement.ru/

Ushatava website, 2018, https://www.ushatava.com/

12 Storeez website, 2018, https://12storeez.com/

Amarket, Spark (May 5, 2017), How Zara earns billions with minimal ads expenditure (Как Zara зарабатывает миллиарды с минимальными вложениями в рекламу) [blog post], retrieved 05/23 from https://spark.ru/startup/amarket/blog/29310/kak-zara-zarabativaet-milliardi-s-minimalnimi-vlozheniyami-v-reklamu

Russian Search Marketing, 2017, 7 Things Russians Expect on your Website [Web blog post], retrieved 05/23 from https://russiansearchmarketing.com/7-things-russians-expect-on-your-website-in-2017/

Alec Leach, Style, Highsnobiety (February 23, 2018), Counterfeit Culture: Moscow – Inside Russia’s Fashion Black Market [online article], retrieved 05/23 from https://www.highsnobiety.com/p/fake-streetwear-russia/

Hofstede Insights, 2018, Country Comparison: Russia [Web page], retrieved 05/23 from https://www.hofstede-insights.com/country-comparison/russia/

Sogrevay Family Look [Web page], retrieved 05/23 from https://www.sogrevay.ru/family-look/

Disclaimer